Publications > Capgemini Consulting > Third-Party Logistics Study > About the Study

|

About the Study

This report presents findings from the 2012 16th Annual Third-Party Logistics Study, which was conducted in mid-2011.

This is the 16th year that the Annual Third-Party Logistics Study has documented the growth and evolution of the third-party logistics (3PL) industry. The study has evolved and expanded over its history to remain as current as possible while offering additional perspective and enhancing its value to both users and providers of 3PL services. For example, while the study has always looked at 3PL services from the point of view of users of 3PL services (shippers), this is the third year that the study also has included the viewpoints of providers of 3PL services.

Four streams of research make up the 2012 3PL Study methodology: a web-based survey, desk research, focus interviews with industry experts and facilitated shipper workshops, two of which were held at Capgemini Accelerated Solutions Environment® (ASE) locations. Study respondents and participants represent a broad range of industries and are predominantly from North America, Europe, Asia-Pacific and Latin America, in addition to other locations throughout the world such as Australia, South Africa and the Middle East.

Multiple research streams and a broad array of perspectives result in a rich and heterogeneous collection of the attitudes, trends and results experienced by 3PL users, non-users and 3PL providers.

Observant readers will note that last year’s study was the 2010 15th Annual Third-Party Logistics Study. The study team chose to call this year’s report the 2012 Study to better reflect the time frame in which the results enjoy the most active and lively discussion.

2012 Study Objective

The overall objective of the 2012 Third-Party Logistics Study is to discover and explore 3PL industry trends, issues, and opportunities.

Each year, the study results together with developments in the global economy and the logistics industry suggest trends that warrant closer examination. Included in the 2012 Study are special topic reports on emerging markets, electronics and talent management.

The 2012 3PL Study also provides perspectives on what shippers and 3PLs are doing to enhance their businesses and their business relationships.

Goals for each portion of the study include:

- Understand what shippers

outsource and what 3PL providers offer.

- Identify trends in shipper expenditures for 3PL services and recognize key shipper and 3PL perspectives on the use and provision of logistics services. - Update our knowledge of 3PL-shipper relationships, and learn how both types of organizations are using these relationships to improve and enhance their businesses and supply chains.

- Quantify the benefits reported by shippers that are attributed to the use of 3PLs.

- Document what types of information technologies and systems are needed for 3PLs to successfully serve customers.

- Comment on the importance of fuel efficiency and carbon emissions information in the 3PL selection process.

- Examine why customers outsource or elect not to outsource to 3PL providers.

Special Topics

- Emerging

Markets: Examine the role of 3PLs in

emerging markets, the challenges faced by both shippers

and 3PLs, and factors that impact the success of

conducting logistics and supply chain activities

in these evolving business environments.

- Electronics:

Conduct an in-depth analysis of the electronics

industry. To identify key issues relating to shippers

and their 3PLs and how they work together to achieve

individual and mutual objectives.

- Talent

Management: Understand the strategic

importance of talent management as a key set of

processes and activities that can greatly influence

the success of a shipper or 3PL operation. This

is the first Annual 3PL Study to consider Talent

Management, and the findings and recommendations

should be instructive for shipper and 3PL organizations

that place a high priority on succession and sustainability

of the talent needed to manage their organizations.

- Strategic

Assessment :

- To provide a view of the future of the 3PL industry and shipper-3PL relationships.

- To comment, as appropriate, on topics that are relevant to the future success of business relationships among shippers and 3PLs.

- To examine ideas that may help to explain how the 3PL sector may work more effectively with its customers and clients to provide meaningful solutions to relevant supply chain issues and challenges.

- Essentially, to provide a forward-looking dialogue that may spawn topics that will end up being future areas of inquiry for the Annual 3PL Study.

2012 Study Methodology

Rapidly changing global and industry dynamics and the evolution of the logistics industry have driven considerable transformation in the capabilities and uses of 3PLs over the sixteen years of this study. To gain insight into these changes, the study team uses four complementary streams of research.

- Web-Based Survey

During the spring and summer of 2011, a link to a web-based survey was sent via email to logistics and supply chain executives in North America, Europe, Asia-Pacific, Latin America, as well as other regions and geographies of the world. In addition to shippers, surveys were sent to executives from companies providing 3PL services in order to gain their perspectives on many of the issues and topics included in the user survey. The study team extends its appreciation to the global organizations that facilitated the participation of their members and contacts in the web-based survey. These organizations are recognized with the respective logos appearing below the Table of Contents for this report.

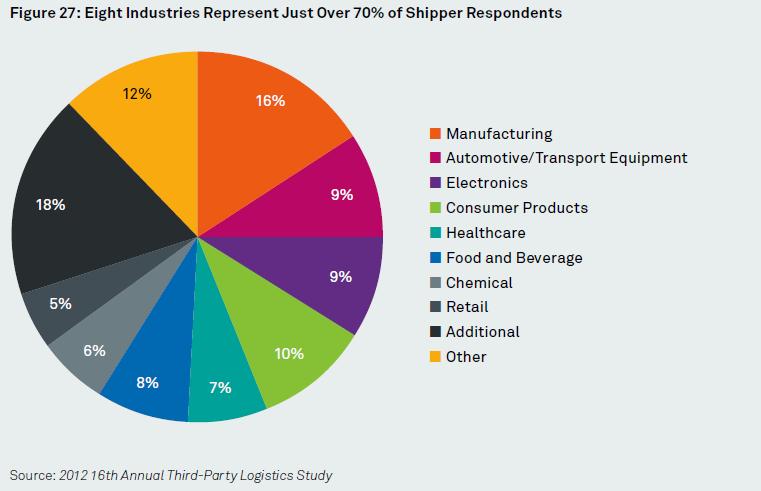

The contact database

of logistics and supply chain executives represented

a wide range of industries, the most prevalent

which were automotive/transport equipment, chemical,

consumer products, food and beverage, healthcare,

electronics, manufacturing, retail, and 3PL/4PL.

The survey was available in English, Spanish,

Portuguese, French and German. To ensure confidentiality

and objectivity, 3PL users were not asked to name

which specific 3PL providers they used.

Survey recipients were asked to think of a ‘‘third-party logistics (3PL) provider” as a company that provides one or more logistics services for its clients and customers and a ‘‘fourth-party logistics (4PL) provider” as one that may manage multiple logistics providers or orchestrate broader aspects of a customer’s supply chain.

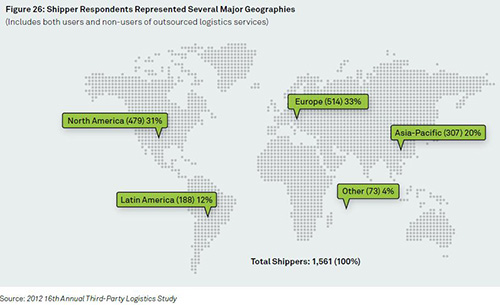

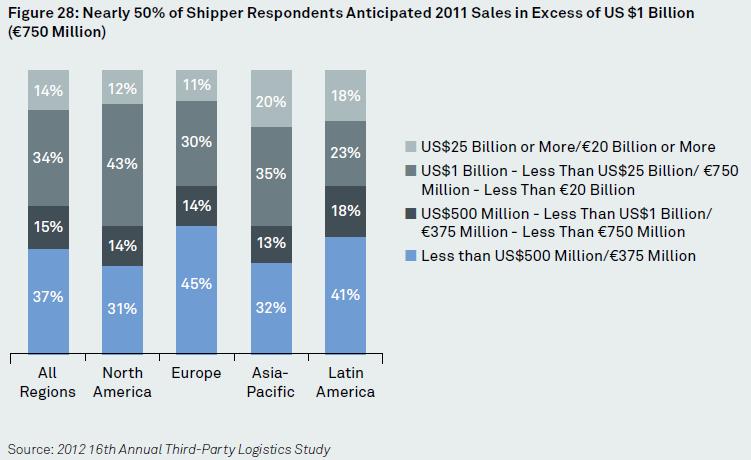

3PL Users: Figure 26 indicates the number of survey responses received from logistics and supply chain executives (i.e., shippers) in various regions of the world. These totals reflect the numbers of users and non-users of 3PL/4PL services who responded to the web-based survey. Many of the shipper survey respondents held corporate positions including Manager/Director, VP/SVP, and Corporate Officer/President/CEO. Figure 27 and 28 provide information on the industry classification and anticipated total sales for 2011 as reported by respondents who identified themselves as users of 3PL/4PL services. A comparison of the sales breakdowns in Figure 28 with those from last year’s study reveals that this year there were more respondents (37%) in the lowest sales category than in the previous year’s study (29%).

3PL Non-Users: Included in the totals shown in Figure 26 are non-users of 3PL services who provided their perspectives on why they do not currently use 3PLs, and on a number of other topics relevant to their classification as non-users.

3PL Providers: Responses were also received from 697 executives and managers representing the provider side of the 3PL business.

General characteristics of these respondents included:

- a wide spread of operating geographies;

- an extensive list of industries served (actually quite similar to the industries represented by the participating 3PL users);

- a range of titles, from managers to Presidents/CEOs;

- approximately 37% of the 3PL firms expected 2011 company revenues in excess of US $1 billion (approximately €750 million), while about 53% reported revenues of less than US$500 million (approximately €375 million).

- Desk Research

The research team, with the support of Capgemini’s Strategic Research Group, assayed a variety of published research related to the special topics to create survey questions and analyze the responses.

- Focus Interviews

Industry observers and experts lent their expertise to the study team through a significant number of ‘‘focus interviews” primarily relating to the special topics addressed in this year’s report. These focus interviews provided exceptionally valuable opportunities to gather pertinent information and perspectives from a wide range of professionals who have knowledge about the 3PL sector and these special topics.

- ASE Workshops

We leveraged the Capgemini Accelerated Solutions Environment® (ASE) as a brainstorming setting where participants, all shippers, collaborated on shared issues. (See www.capgemini.com/ase for more about ASEs.) To better understand the results of the survey and to gain valuable perspective from 3PL users, the research team held facilitated ASE sessions based on sample supply chain challenges related to the study material. ASE sessions were held in Chicago, Illinois and in Utrecht, The Netherlands. A similar, non-ASE workshop, which included a broader base of participants, was held in June, 2011, at the eyefortransport 3PL Summit held in Atlanta, Georgia.

- Follow-Up Activities

In addition to this publication, the results of the 2012 16th Annual Third-Party Logistics Study will be presented in a variety of venues.

These include:

- Presentations at influential industry conferences such as the Council of Supply Chain Management Professionals (CSCMP), eyefortransport 3PL Summit and Chief Supply Chain Officer Summit.

- Analyst briefings that are typically conducted in the weeks following release of the annual study results in the fall of each year.

- Magazine and journal articles in publications such as Supply Chain Management Review, Logistics Management, Inbound Logistics, Logistics Quarterly, and Supply Chain Quarterly.

- Webcasts conducted with media and publications such as Supply Chain Management Review, Logistics Management, and others.

- A web site, www.3PLstudy.com, which includes copies of the report for download as well as supplementary materials.

About the Sponsors

- Capgemini

With 112,000 people in 40 countries, Capgemini is one of the world’s foremost providers of consulting, technology and outsourcing services. The Group reported 2010 global revenues of EUR 8.7 billion.

Together with its clients, Capgemini creates and delivers business and technology solutions that fit their needs and drive the results they want. A deeply multicultural organization, Capgemini has developed its own way of working, the Collaborative Business Experience™, and draws on Rightshore®, its worldwide delivery model.

Capgemini Consulting is the Global Strategy and Transformation Consulting brand of the Capgemini Group, specializing in advising and supporting organizations in transforming their business, from the development of innovative strategy through to execution, with a consistent focus on sustainable results. Capgemini Consulting proposes to leading companies and governments a fresh approach which uses innovative methods, technology and the talents of over 3,600 consultants worldwide.

- Penn State University

Penn State is designated

as the sole land-grant institution of the Commonwealth

of Pennsylvania. The University’s main campus

is located in State College, Pennsylvania. Penn

State’s Smeal College of Business is one

of the largest business schools in the United

States and is home to the Supply

Chain & Information Systems (SC&IS) academic

department and the Center for Supply Chain Research

(CSCR). With more than 30 faculty members and

over 600 students, SC&IS is one of the largest

and most respected academic concentrations of

supply chain education and research in the world.

SC&IS offers supply chain programs for every

educational level, including undergraduate, graduate,

and doctorate degrees, in addition to a very popular

online, 30-credit professional master’s

degree program in supply chain management. The

supply chain educational portfolio also includes

open enrollment, custom, and certificate programs

developed by Smeal’s Penn State Executive

Programs and CSCR, which helps to integrate Smeal

into the broader business community.

Along with executive education, CSCR focuses its

efforts in research, benchmarking, and corporate

sponsorship. CSCR corporate sponsors direct the

Center’s research initiatives by identifying

relevant supply chain issues that their organizations

are experiencing in today’s business environment.

This process also helps to encourage Penn State

researchers to advance the state of scholarship

in the supply chain management field.

Penn State’s Smeal College of Business has the No. 1 undergraduate and graduate programs in supply chain management, according to the most current report from Gartner.

For more information,

please visit

www.smeal.psu.edu/scis

and

www.smeal.psu.edu/cscr

- The Panalpina Group

The Panalpina Group

is one of the world’s leading providers

of supply chain solutions, combining intercontinental

Air and Ocean Freight with comprehensive Value-Added

Logistics Services and Supply Chain Services.

Thanks to its in-depth industry know-how and customized

IT systems, Panalpina provides globally integrated

door-to-door solutions tailored to its customers'

supply chain management needs. The Panalpina Group

operates a global network with some 500 branches

in more than 80 countries. In a further 80 countries,

it cooperates closely with partner companies.

Panalpina employs approximately 15,000 people

worldwide.

Panalpina has extensive experience with customers in many key industries. With dedicated experts in key global markets, Panalpina has the people, products, skills and capabilities to meet the demanding needs of its global customers.

Panalpina delivers reliable Supply Chain Solutions that provide value to our customers -every time. No matter what the size, exact business and location is- we are always driven by qualitative, safety-related and environmental principles that best serve our customers’ and thus our own long-term interest.

For more information

please visit

www.panalpina.com

![]()

- Heidrick & Struggles

Heidrick & Struggles, the leadership advisory firm providing senior-level executive search and leadership consulting services, has one of the industry’s leading, dedicated Transportation and Logistics practices round the globe. We have a demonstrable track record of delivery in each niche of the segment with truly global coverage. Clients include Integrators, Freight Forwarders, 3PL Providers, Ocean Carriers, NVOCCs, Airlines, Rail Operators, Port Operators, Terminal Operators, and Airport Operators. Our relationships go beyond cargo transportation and logistics companies themselves as further convergence emerges in the industry – we hold key relationships with PE Firms, venture capitalists, infrastructure funds, deal makers (both buy and sell side), investment bankers, management consultants and the academic community. We know the talent and with our team dispersed all over the world, we are uniquely equipped to serve an industry that is being redefined locally, regionally and globally.

For more information,

please visit

www.heidrick.com

![]()

- eyefortransport

Established in 1998, eyefortransport has become one of the leading providers of business intelligence, independent research, news and executive level events for the supply chain & logistics industries. Eyefortransport has two primary focuses.

1) To provide executive networking opportunities in the supply chain & logistics industries via the more than 15 events we annually organize and host in North America, Europe and Asia and online via the tens of thousands of users of www.eft.com. The events are designed to complement and enhance the business connections available through our online network, and bring together the industry elite. Regularly attended by CEOs and senior management from the transport and logistics industry and Heads of Supply Chain of major companies, the events focus on current developments and latest trends, and are enhanced by high-level, exclusive networking opportunities.

2) To deliver industry education through dozens of industry reports, surveys, newsletters, webinars and senior-level presentations at leading events.

For the list of current

research, news and conferences we produce please

visit

www.eft.com

Credits

The 16th Annual 3PL Study team would also like to thank all of the companies and individuals who shared their experiences and insights with us through focus interviews, ASE workshops and the workshop at eyefortransport. Your contributions are invaluable to the analysis of the survey results and the ideas expressed in this report.

The authors of the study would like to thank eyefortransport; the Shanghai Logistician Club (ShLC); the hungarian Association of Logistics; the Latin America Logistics Center (LALC); EVO, the Dutch Shippers’ Council; The Logistics Institute-Asia Pacific (TLI-AP); Supply Chain Digest; the Supply Chain Council and the national Shippers Strategic Transportation Council (nASSTRAC) for serving as supporting organizations for this 16th Annual Third-Party Logistics Study. under the guidance of Executive Director Maria F. Rey, the LALC provided contact information for Latin American executives, and also translated the entire survey into Spanish and Portuguese.

Lead Writer: Lisa Terry

The study team expresses its appreciation to Jim Morton, Director of the Study Project, and Brett Fletcher, Project Manager, both of Capgemini Consulting, for their diligent and helpful work as leaders of this year’s study.

Disclaimer:

The information contained herein is general in

nature and is not intended as, and should not

be construed as, professional advice or opinion

provided by the sponsors (Capgemini, Penn State,

Panalpina, Heidrick & Struggles and eyefortransport)

to the reader. While every effort has been made

to offer current and accurate information, errors

can occur. This information is provided as is,

with no guaranty of completeness, accuracy, or

timeliness, and without warranty of any kind,

expressed or implied, including any warranty of

performance, merchantability, or fitness for a

particular purpose. In addition, changes may be

made in this information from time to time without

notice to the user. The reader also is cautioned

that this material may not be applicable to, or

suitable for, the reader’s specific circumstances

or needs, and may require consideration of additional

factors if any action is to be contemplated. The

reader should contact a professional prior to

taking any action based upon this information.

The sponsors assume no obligation to inform the

reader of any changes in law, business environment,

or other factors that could affect the information

contained herein.

Index:

About Capgemini Consulting

With more than 115,000 people in 40

countries, Capgemini is one of the world’s

foremost providers of consulting, technology

and outsourcing services. The Group reported

2010 global revenues of EUR 8.7 billion.

Together with its clients, Capgemini creates

and delivers business and technology solutions

that fit their needs and drive the results

they want. A deeply multicultural organization,

Capgemini has developed its own way of

working, the Collaborative Business ExperienceTM,

and draws on Rightshore®, its worldwide

delivery model.

Capgemini Consulting is the Global Strategy

and Transformation Consulting brand of

the Capgemini Group, specializing in advising

and supporting organizations in transforming

their business, from the development of

innovative strategy through to execution,

with a consistent focus on sustainable

results. Capgemini Consulting proposes

to leading companies and governments a

fresh approach which uses innovative methods,

technology and the talents of over 3,600

consultants worldwide.