Publications > Editions EMS > Les corridors de transport > Maritime Highway Corridors into the Caribbean Seas: Perspective on the impact of the opening of the expanded Panama Canal in 2014

|

Par

Fritz Pinnock

& Ibrahim Ajagunna

Par

Fritz Pinnock

& Ibrahim Ajagunna

Executive Director & Director of Academics

Caribbean Maritime Institute - Kingston -

Jamaica

Biographies

FRITZ

PINNOCK

FRITZ

PINNOCK

Fritz Pinnock is the Executive Director

at The Caribbean Maritime Institute. His experience

in the shipping and transportation industry spans

over two decades. Fritz holds a Doctor of Philosophy

in sustainable development from the University of

the West Indies. He also holds a Master of Science

Degree from University of Playmount, UK. His consultancy

services in strategic management have been extended

to many Caribbean Islands including Jamaica, Barbados,

Antigua and Guyana. Fritz has written and presented

papers at various conferences both within the shipping

and transportation industry and educational institutions.

Fritz is an expert in developing and integrating

operational and strategic plans; reengineering,

cost cutting control, and managerial systems development.

IBRAHIM

AJAGUNNA

Ibrahim Ajagunna has his early education and training

in Nigeria. Ibrahim holds a Higher National Diploma

in Hospitality Management from the Federal Polytechnic

Idah Nigeria, A Master of Science degree from Sheffield

Hallam University, UK, a Post Graduate Diploma in

Education from the University of Technology and

a Doctor of Philosophy in Sustainable Development

from the University of the West Indies, Jamaica.

Ibrahim is well versed in curriculum development

and course delivery. Ibrahim has participated and

presented papers at various conferences and seminars

and has also published materials in reputable international

journals and has written book chapters in the areas

of tourism management. Ibrahim has experiences locally

and internationally in management position both

in the Tourism and Hospitality industry and at Educational

Institutions. Ibrahim is the immediate past vice

president of the Council of Heads of Caribbean Hospitality

Schools, Jamaica. He is a member of the Board of

Studies for Tourism and Hospitality, University

Council of Jamaica, and a member of Hotel and Catering

International Management Association, UK.

Introduction

The

United States Merchant Marine Act of 1920, commonly

called the Jones Act was implemented as the primary

cabotage legislation protecting US costal shipping.

According to the Act, all goods transported by water

between US ports must be carried by US flag ships,

constructed in the US, owned by US citizens and

crewed by US citizens. With over 90 percent of global

container liner tonnage registered with flags of

convenience, the Jones Act has been approached by

the global shipping industry as a legislation to

avoid rather than comply with. The notion of transshipment

hubs, has been the primary strategic tool in circumventing

the Jones Act. Cargos destined for the United States

are transported to a central location outside of

the US waters (on large vessels known as main liners),

which are then re-parceled into smaller ships known

as feeder vessels and distributed throughout US

ports.

The

United States Merchant Marine Act of 1920, commonly

called the Jones Act was implemented as the primary

cabotage legislation protecting US costal shipping.

According to the Act, all goods transported by water

between US ports must be carried by US flag ships,

constructed in the US, owned by US citizens and

crewed by US citizens. With over 90 percent of global

container liner tonnage registered with flags of

convenience, the Jones Act has been approached by

the global shipping industry as a legislation to

avoid rather than comply with. The notion of transshipment

hubs, has been the primary strategic tool in circumventing

the Jones Act. Cargos destined for the United States

are transported to a central location outside of

the US waters (on large vessels known as main liners),

which are then re-parceled into smaller ships known

as feeder vessels and distributed throughout US

ports.

The Caribbean, which is a crescent-shaped group

of islands more than 3200 km long separating the

gulf of Mexico and the Caribbean Sea, to the west

and south, from the Atlantic Ocean, to the east

and north. This includes Panama and Central America.

By virtue of its proximity to the United States,

the Caribbean forms the most likely transshipment

hub port network to serve the United States. The

expanded Panama canal in 2014 presents new opportunities

for the Caribbean as the increase in the size of

vessels from 4000 to 12000 TEUs transiting the canal,

will provide greater opportunities for transshipment

in the Caribbean to access the US east coast more

competitively.

Classification of Caribbean Ports

Most Caribbean states are classified as micro-states, with heavy dependence on services such as tourism and off-shore banking being among the primary areas of economic activity. These states are also reliant on imports from North America and the Far East, supported with limited inter and intra-regional trade. Additionally, import parcel sizes are small by global standards, therefore not providing a large enough economic base to support development of modern port facilities. As such, the whole concept of containerisation has been one of the greatest impacts on Caribbean small ports, which were designed to support colonial economic sources of bulk importation of basic items and exportation of bananas and sugar. The Caribbean countries over the years have done their best to modernise old general cargo ports to accommodate newer container ships, which further compounded the pressures that these ports face.

The sizes of ships have constantly been growing with improvement in technology whereby there are increasingly more specialised container ships with no ship board container crane facilities, putting pressure on Caribbean ports to provide shore base cranes and the supporting pier side container handling infrastructure. Consequently, general cargo port configuration, which includes large transit sheds, used primarily for storing sugar and bananas, have to be removed to create open large storage areas for container traffic.

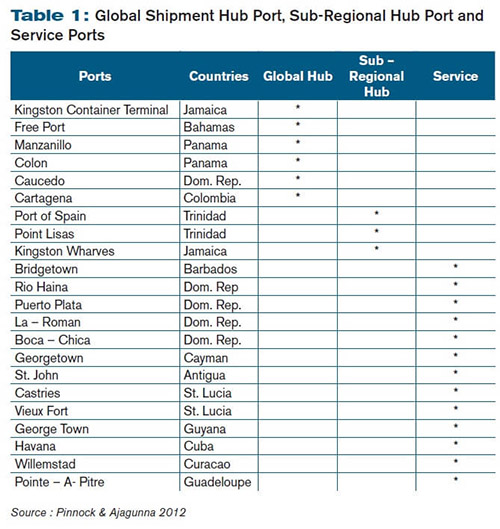

The Caribbean’s dependence on maritime transportation for trade is logical based on the fact that the states share the common space of the Caribbean Sea. Some states have strategically invested heavily in creating modern port infrastructure in attempt to capitalize on their geographic location by offering their services as global transshipment hub port, and sub-regional hub ports. The rest operate as service ports catering to domestic economic needs.

Following on these, the authors have classified Caribbean ports into three categories of Global hub port, Sub-regional hub ports and Service ports as shown in Table below:

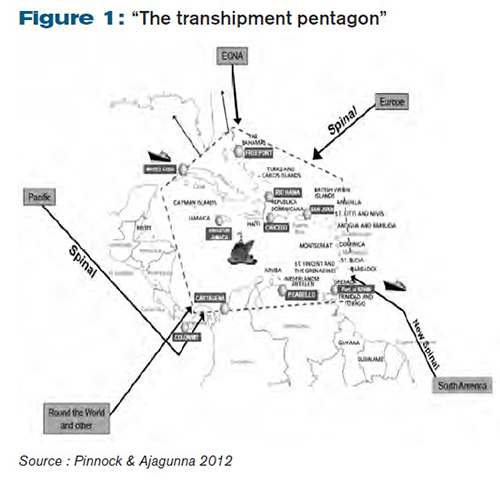

The New Caribbean "Transshipment Pentagon" - Post 2014 Expansion of the Panama Canal cxde"

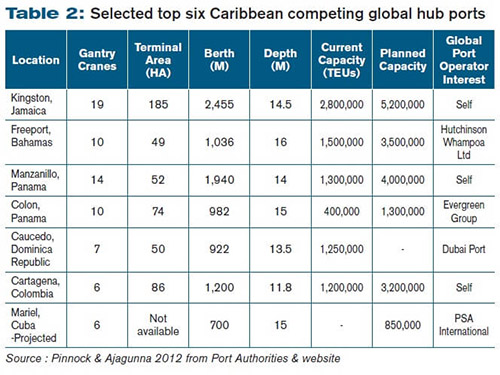

Based on the interest and investments in the region by global port operators, there will be no single global hub port in the Caribbean. Based on terminal capacity highlighted in table 2, it is obvious that no more single port has the capacity to serve the entire region. Manzanillo, Cartagena and Kingston Container Terminal (KCT) are the only three ports that are not manage by a global shipping lines or any of the top six port management companies in the world. ZIM integrated services is the single largest user of KCT, and based on the capacity expansion, which is planned by the port, it could be joined by CMA CGM providing a new terminal.

Following a 2009 agreement between the government of Brazil and Cuba, the Brazilian Engineering group (Grupo Odebrecht) was contracted to build a new port including a major container terminal with projected capacity as shown in the table above. This addition to the Caribbean competing global hub ports will change the current projection from the "Caribbean transshipment triangle" to become "Caribbean transshipment pentagon" as defined by the authors.

The global container-shipping industry is the backbone of intercontinental supply chains, accounting for some 98 percent of inter- continental containerized trade volume and 60 percent of trade value. In addition, the global shipping industry is driven by two forces of scale and technology and the Caribbean, comprising a group of small islands sharing space, are challenged to find relevance within this paradigm.

It is true that sustained globalization and global logistics would not be possible without a dense and efficient transport network. It is equally true that both the concept of globalization and global logistics and their enabling tools such as information technology and intermodal transportation have had a tremendous impact on maritime transport. Both globalization and global logistics trends beg the question "how does the Caribbean fit into this picture"?

Given the poor performance of most container terminals in the Caribbean, it is not surprising that handling charges are two or three times as high as in similar ports in other regions and that the overall cost of transport and insurance in the Caribbean basin is some 30% higher than the world average. For example, between the port of Shanghai, China and the port of Los Angeles, USA, a distance of 19,270 nautical miles attracts a freight rate of approximately USD 700. On the other hand, the distance between the port of Kingston, Jamaica and Orangestead, Aruba, a distance of 513 nautical miles attracts an average freight rate of USD 2,800.

The Caribbean Case Scenario

The Panama Canal is a major gateway for cargo moving from the Far East to the US East Coast. This route competes directly with cargos moving from the Far East to US West Coast and access the intermodal transportation network to the US East Coast. In fact, the prospect for Caribbean transshipment involvement is integrally tied to the efficiency and competitiveness of the expanded Panama Canal. The following key drivers to transshipment will influence the highly coveted Caribbean hub port status:

- port must be located at the cross roads of main maritime trade routes

- productivity of stevedoring operations

- guarantee of berths

- competitive tariff

- control of operations

- safety and security

- dedicated feeder services

Within the Caribbean, Kingston; Freeport, Bahamas; Port of Spain, Trinidad & Tobago; Caucedo, Dominican Republic; Panama and Colombia are major competing hubs. Sánchez and Wilmsmeier (2009), point out that the number of services and the number of directly connected ports describe well the embeddedness of terminal in the global network and simultaneously the potential for import and export development of the respective hinterland. But connectivity alone is not sufficient to explain port throughput. Although there is no doubt that containerization is a necessary condition to increase trade in the Caribbean, its very presence does not guarantee that such development will occur. The reach of shipping networks from a country or port however shows potential trade opportunities. This is particularly true for smaller ports that rely on feeder and small vessel services. These ports, according to Sánchez and Wilmsmeier, do not depend on their direct connectivity, but on the connectivity to a transshipment hub, which defines their integration in the global liner-shipping network.

Industry experts believe that the expansion of the Panama Canal is opening a new phase for transshipment in the Caribbean. According to Rodrigue and Notteboom (nd), it is important to underline that, at the global level, only 17 percent of the commercial relations involve direct connections between ports, so transshipment is a fundamental aspect of maritime shipping networks.

In recent years, an active transshipment market has emerged in Panama and the Caribbean, particularly within what has been dubbed as the 'transshipment triangle’. However, the authors are projecting a new configuration, as Cuba should not be left out in the projection. The investment into the new Mariel terminal and the proposed management by global operator PSA will be a game changer thereby changing the configuration from "transshipment triangle" to "transshipment pentagon" (Figure 1).

This new configuration of multiple global hub ports will also attract a new layer of sub-regional hub ports as per classification by the authors in figure 1 above. Not all of the current competing hub ports will make it as global hub port with the introduction of Mariel hub port in the equation. This would mean that some of the current competing global hub ports would compete with Kingston Wharves Limited, Jamaica and Trinidad and Tobago Point Lisas. The traditional Caribbean service ports will continue to operate at subsistence level, but would be forced to do some upgrade on the current facility in order to remain competitive due to the increase in size of ships.

The growth in Caribbean transshipment activities is connected to issues such as economic growth in Latin America (being at the crossroads of trans-Atlantic and north-south trade flows) and the need of shippers to reconcile these numerous inbound and outbound trade flows within their shipping networks. Transshipment activities are thus a mix of hub-and-spoke network configurations as well as interlining between long distance shipping routes. The advantages gained in terms of network inter-connectivity and better usage of ship assets outweigh the additional handling costs that transshipment entails. According to Rodrigue and Notteboom, the expansion of the Panama Canal comes at a time in world trade developments that is prone to uncertainties, since the main trade drivers, such as American import-based consumption, are being questioned while new trade relations are not firmly established. In addition, South America represents a remarkable potential for additional volumes and transshipment activities.

In the "pentagon transshipment" hubs, local and regional carriers will play a major role in local trade, but may be threatened to lose global and some of the regional trade due to growing alliances between global operators. These operators can offer more competitive prices when exploiting economies of scale. Local and regional carriers can only compete in service and not in price, as their advantages lie in close customer relations with preferences and flexibility in payments. Regional carriers for example, are largely niche carriers specializing in "less than container Load" (LCL) and mixed container loads and non-containerized goods (especially in interisland trade). Such services are specialized in handling cargo such as three boxes, three pallets or three containers. These types of handlings are very difficult for big operators, as they do not fit in their rationale for cargo handling.

Panama Canal Expansion & Consequences on Logistics and Maritime Network

The maritime component, ships and ports, are two elements constituting the movement of goods from one point to another, or from one country to another. The sum total of unique transportation arrangements is referred to as the "supply chain", the management of which is referred to as logistics. The goal of logistics is the movement of goods, services and information across borders rapidly, reliably and cheaply. This in turn facilitates trade and development.

The goal of logistics should go well beyond the sea and encompass trade facilitation, customs modernization, the promotion of electronic processing of trade documents, improvement access to trade and transport information for the purpose of tracking and tracing, processing and approval, and the cultivation of local logistics competence in forwarding, trucking, and freight consolidation (Pinnock and Ajagunna, 2012). The approach to production, trade and transportation has evolved incorporating freight logistics as an important value added services in the global production. The major challenge facing the Caribbean nations is how to connect to global supply chains and maximize the opportunities from global transshipment hubs. This highlight the urgent need for countries to invest in port community systems so as to connect individual players in real time, thereby creating the value added platform for 3PL logistics companies.

Port costs ripple right through national economies, especially those of small island-states. In fact, port costs affect the price of goods and services in nearly every sector of the economy. Competitiveness requires a modern, well-managed, cost-effective port system. While the standards of infrastructure in some Caribbean countries can be considered as acceptable, a major problem has been its maintenance. Other problems of infrastructure in Caribbean are: inadequate management; tariffs that are too low to support the services; accumulated debt; and, discontented customers. The state of logistics infrastructure is also affected by the Region’s vulnerability to natural disasters, and the tendency of governments to make decisions concerning major investment projects without appropriate hazard assessment and information on mitigation measures.

Conclusion

The expanded Panama Canal will definitely be a game changer for the Caribbean and thereby creating more competitive access to US east coast. Cuba will no doubt be a factor in the equation thereby creating a new configuration of global competing hub ports from the "transshipment triangle" to the new "transshipment pentagon". Caribbean transshipment ports are classified by the authors into three layers namely, Global hub port; Sub-regional hub ports and Service ports. Global hub port status will be shared by at least three major ports based on investment into existing hub ports by global port management companies and shipping lines. KCT, Jamaica; Cartagena, Colombia; and, Manzanillo, Panama are the non-aligned competing hub ports that could swing the pendulum based on new investment in the region.

Industry experts have argued that, both large container ships; declining freight rates; overcapacity in the global shipping industry; and, carrier consolidations will have tremendous impact on the industry going forward. Finally, the Canal expansion will impact the regional shipping industry through growth in the size of ships traversing the Canal. Ships in the 4,000 to 12,000 TEUs range will be plying the North/South trade routes with increasing vessel-sharing agreements formulated to pull service volumes together; and continued growth and expansion of transshipment ports across the Caribbean.

References

ALIX, Y. and PINNOCK, F., (2012) « La expansión del Canal de Panamá: reflexiones libres sobre las oportunidades a los puertos de transbordos en los Caraïbes”. VII reunión de la Comisión Interamericana de Puertos (CIP). Organización de los Estados Americanos. 14 al 16 de Marzo de 2012. Lima, Perú. Available at www.seacil.com

ALIX, Y. and PINNOCK, F. (2012) ‘‘Which innovation to drive the change in the 2020 Global Transportation Network?” The Caribbean Shipping Association International Conference. 21th & 22th of May 2012, Jacksonville, USA. Available at www.sefacil. com

HYLTON, N. (2011) ‘‘The expansion of the Panama Canal”. Unpublished paper presented at the 2011 CSA conference Barbados.

PINNOCK, F. and AJAGUNNA, I. (2012). The expansion of Panama Canal and challenges for Caribbean ports. Caribbean Maritime Institute.

RICARDO J., SANCHEZ R.J., and WILMSMEIER,G. (2009) ‘‘Maritime sector and ports in the Caribbean: the case of CARICOM countries”. Natural Resources and Infrastructure Division Santiago, Chile.

RODRIGUE J.-P. and NOTTEBOOM, T. (2011) ‘‘The Panama Canal expansion: Business as usual or game-changer?” Available at www.porttechnology.org

SOMMAIRE

Préface

Par Antoine Rufenacht

Chapitre

éditorial

Par Yann Alix

Chapitre introductif

Corridors

de transport et évolution globale

des échanges

Par Gustaaf de Monie

PARTIE 1 - Approches méthodologiques

Chapitre

1

Définition

et périmètre des grands

corridors de transport fluvio-maritime

Par Claude Comtois

Chapitre 2

Les

indicateurs de performance logistique

pour les corridors de transport

Par Jean-François Pelletier

Capsule professionnelle 1

Les

observatoires des transports en Afrique

Sub-saharienne

Par Olivier Hartmann

Chapitre 3

Gouvernance

des corridors de transport et des gateways

Par Juliette Duszynski et Emmanuel

Préterre

Capsule professionnelle 2

Corridors

maritimes et terrestres : quelles stratégies

pour un opérateur de lignes régulières

?

Par Luc Portier et Alexandre Gallo

PARTIE 2 – Approches techniques

Chapitre 4

Corridors

de transport et construction du statut

juridique de l’entrepreneur de transport

multimodal

Par Valérie Bailly-Hascoët

et Cécile Legros

Capsule professionnelle 3

Gestion

des frontières, enjeux douaniers

et corridors de transport : retours d’expériences

douanières

Par Lionel Pascal

Capsule professionnelle 4

Frets

aériens et corridors humanitaires

: retours d’expérience suite

au tremblement de terre à Haïti

Par Alain Grall

Chapitre 5

Approches

technologiques et gestion des flux immatériels

sur les corridors de transport : exemples

brésiliens

Par Michel Donner

Capsule professionnelle 5

Dématérialisation

des flux d’information sur un corridor

multimodal de transport : retour d’expériences

de l’Axe Seine

Par Alain Savina et Laurie Francopoulo

PARTIE 3 – Approches stratégiques

et prospectives

Chapitre 6

L’évolution

des organisations productives et logistiques.

Impacts sur les corridors de transport

Par Jérôme Verny et Yann

Alix

Capsule professionnelle 6

Toward

efficient and sustainable transport chains:

the case of the port of Rotterdam

Par Peter de Langen

Chapitre

7

Corridors

of the Sea : An investigation into liner

shipping connectivity

Par Jan Hoffmann

Capsule professionnelle 7

Evolution

des corridors de transport maritime de

pétrole brut

Par Frédéric Hardy

Chapitre

8

Strategies

and future development of transport corridors

Par Théo Notteboom

Capsule professionnelle 8

Maritime Highway Corridors into

the Caribbean Seas: Perspective on the

impact of the opening of the expanded

Panama canal in 2014

Par Fritz Pinnock and Ibrahim Ajagunna

Chapitre de conclusion

Les

corridors de transport : objets en faveur

d’une mobilité durable ?

Par Jérôme Verny

Postface

Par Marc Juhel